Stats also show that 85% of people who save do so to reach a particular goal with the average savings target of people being $11,234. Unfortunately, not everyone is able to keep up with their savings’ resolutions. 41% of people break their financial resolutions because of change in financial situations, 27% do so because of lack of motivation and 17% are unable to save because of unrealistic goals. a graph to show you how low the household savings ratio has gone from 2008 to 2018:

However, don’t let your hopes die out just yet. Saving money in Australia doesn’t have to be a far-fetched dream. You can have a look at how a smart money-savvy person here reaches his savings goals and follow the same route. To help you out, here are some tips on how Australians save money:

1 - Saving On Bills By Choosing Cheap Providers

Forget to switch off the extra lights in the house and to cancel the data plan subscription on your phone that you’re no more using, and you’ll quickly see the bills rise up. However, Australians can be smart in this regard by saving by going for cheap energy providers. A list of energy providers can be accessed via the government’s

Energy Made Easy site.

Reports say that Aussies will soon be able to save more on energy as renewable energy sources are being explored which will enable savings of

about $28 in 2021. Moreover, mobile and data plans can also be compared to see which can be more economical. Optus is one data plan provider known for its cheap services in Australia.

2 - Saving On Eating Out

You can also save money on eating out in restaurants not by sticking to meals at home but by being smart. For instance, instead of spending bucks on another day, choose to eat out when Happy Hours are running or on Cheap Tuesdays. What’s more, a smart saver is likely to avoid ordering beverages at outlets as there the prices are awfully high.

Additionally, another good move that many make use of is that they avoid eating out on busy days such as weekends. Instead, they go for the dining out on weekdays when less people are likely to crowd restaurants. Tipping isn’t very much of a concept in the country, so that also adds a few coins to the piggy bank.

3 - Saving On Student Expenses

Students can also save in the nation by being wise. Instead of investing in books that may not come to use after a year, they rent books. If a book needs to be bought, you can go for book exchanges which can get you second-hand books. As a student, you can also use your student card which will enable to shop at slashed down prices.

Travelling to-and-fro the campus can be done by using a Trans Perth card.

Student discounts are also offered by many brands which allows students to purchase clothing at much better prices. Many universities offer health services for free so that’s a perk that many local as well as international students in Australia avail as well for saving money.

4 - Saving By Choosing The Right Account

A person’s saved money is supposed to go somewhere, right? Unfortunately, not all banks are inexpensive as some demand a herculean amount in fee charges. In 2014, Australians paid $1 billion approx. to banks for making transactions. Smart Australians explore all the options they have before committing with a bank and flashing out cash for charges.

To make everyday transactions easy many use fee-free accounts. While no options are entirely free, some worthwhile options here include NAB and Citibank. For international transactions, a reliable and relatively cheap option to select is TransferWise.

5 - Saving On Home Renovation

Home maintenance is essential as your house needs care for continually looking good. Apart from the aesthetics point of view, renovation can also be necessary to protect your house from damage. Moreover, renovation is also worth the costs because of the ROI that comes with it. Looking that 40% of Australians save for renovating or buying their home, it is clear that many people take it seriously.

However, it is not necessary that you blow all your money when renovating your home. You can save here as well by skipping expensive flooring and other materials for cheaper options. You can save by going for

discount on buying and renovating the house and refurbishing and reusing where possible. Furthermore, it is more cost-friendly to go for professionals in technical tasks rather than taking the DIY route.

6 - Saving On Travelling

There are always ways you can save on travelling so that you keep doing it at least once annually. The first pointer to keep in mind here is to do your research. Be sure that you are using

travel discount in Australia which you can find by searching for promo codes such as

Adrenaline Promo Code. Be smart about the route you choose.

Visit a country when it isn’t the time of the year when many people could be visiting it. Moreover, don’t take extra luggage as that will add to charges. As an Aussie when travelling abroad make sure you don’t withdraw directly from an ATM as that wouldn’t only charge you ATM fees but also currency conversion fees. A better option is to withdraw using your 28 Degrees MasterCard or Citibank Visa Debit Card. This will save you currency conversion fees.

7 - Saving On Transport In Australia

There are several modes of transport in Australia. From buses, cars, cycles to ferries, trains, and airplanes, people have many options. A cheap option are buses, particularly transport via the national service of Greyhound buses. However, keep in mind that transportation through buses is a pretty slow option. One can use travel via ferries too, but an opal card is needed for that.

You can also use top-up smart cards for cheap transportation. Moreover, when travelling from one province to another, book your airport parking beforehand otherwise the costs will be higher. Also, know that taxis such as uber can be quite expensive. Hence, it is best to compare prices before booking one.

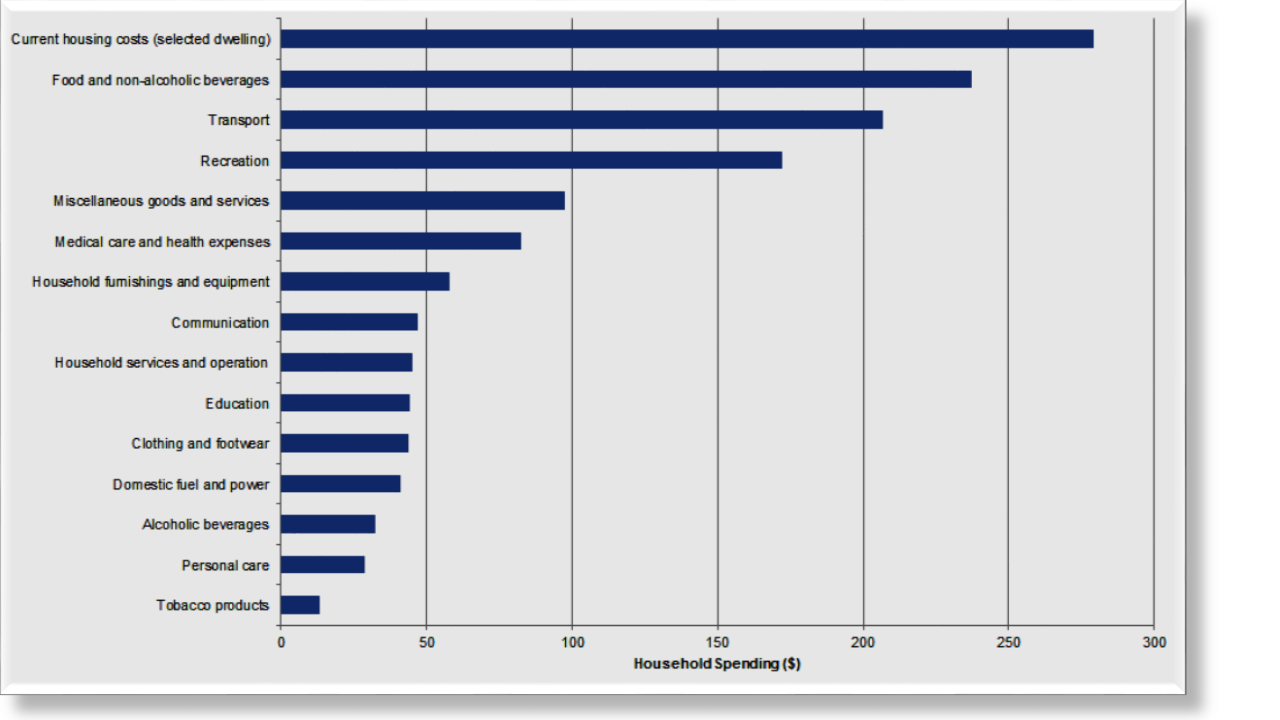

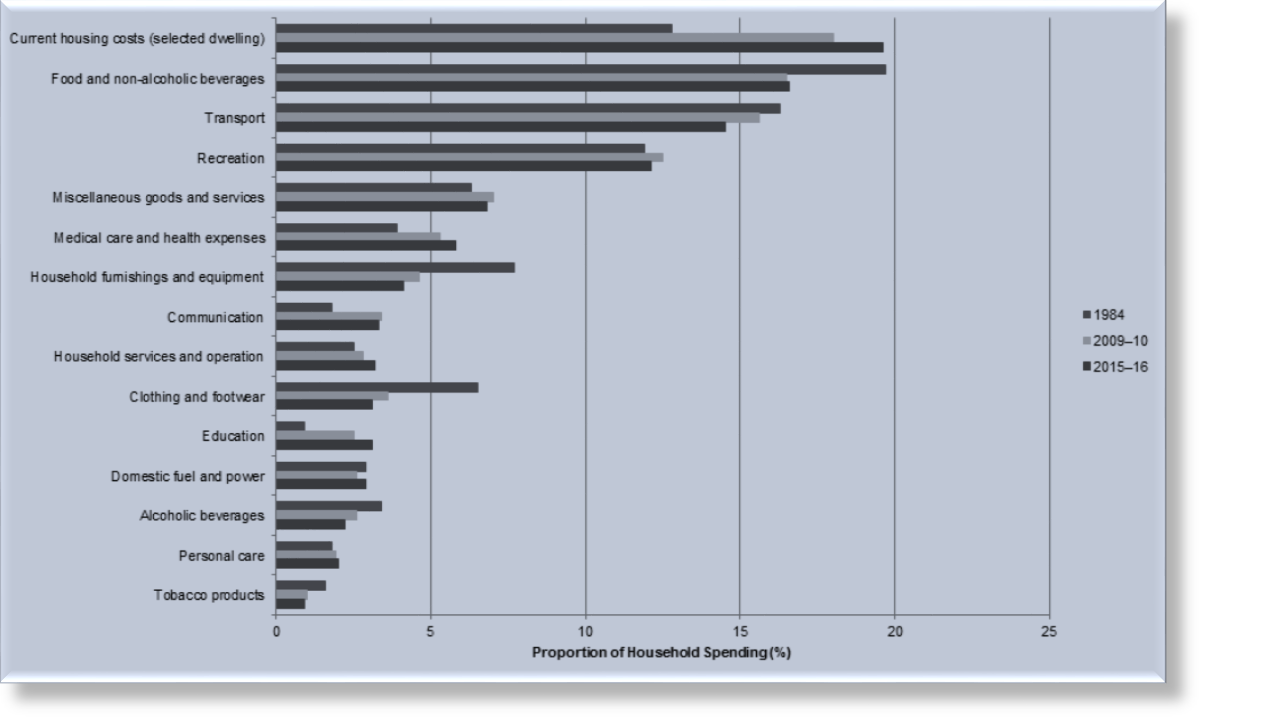

A glimpse at this graph of

how Australians spend their money shows that a lot of the household spending of an Australian goes to transport which stresses that more people need to save in this area. However, compared to previous years spending in this sector has lowered.

8 - Saving On Clothing And Fashion

Did you know that Australians spend the most on clothing compared to everyone else in the world? Surely, we need to take some measures here to save more than spend. The best trick in town is that of using hand-me-downs coming from older siblings or relatives. Clothing exchanges are also a popular way to

save money on fashion.

Additionally, you can also shop when a sale is running such as the Black Friday or Cyber Monday sale and purchase fashion items when it is not their season. You can also purchase from markets rather than outlets of brands for saving. Additionally, you can enroll in loyalty programs as well to get exclusive deals.

Other Tips For Saving Money That Australians Use

There are several reasons people want to save money. The top money goals of Australians include saving for emergencies, vacations, and home renovations. To go in-depth, 53% of Australians save money to go on a holiday, 46% do so for sudden emergencies, and 40% save money for purchasing or renovating their homes.

Other than these primary goals, people also save money for when they retire, controlling and paying off debts, and for investment in bonds, shares, commitments as well as properties. Over and above that, some folks save to set up a proper budget for their present as well as future.

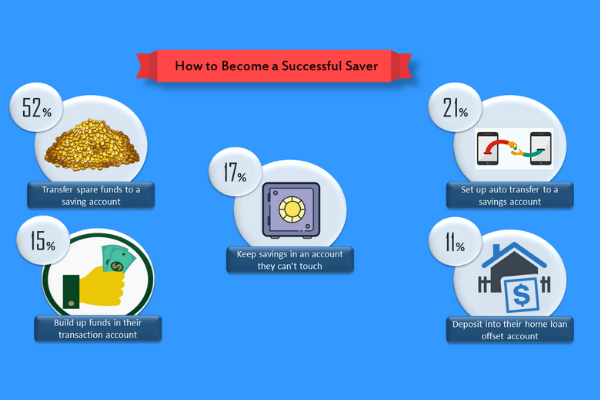

However, saving money can be challenging with new expenses coming up month after month. However, there are some tricks that you can use to reach your savings goals. Take a page from the book of successful savers. 52% of these transfer their funds which aren’t of use to a savings account. This is a helpful trick as the money which isn’t in sight, as in the wallet, is comparatively easy to keep away from.

For this reason, 17% of people also save their money in a place they can’t reach conveniently. What’s more, 21% of savers save by automatically transferring their money to a savings account which keeps them from backing out from saving money while 15% build savings in their normal transactions account. Lastly, 11% of money savers deposit bucks in their home load offset account.

Here’s a tip from Canna Campbell, financial Expert, who told HuffPost Australia, “It comes down to a good habit system -- being on budget and in control, paying for things in cash as it forces you to be conscious when you purchase, write goals so you have something you're actively working towards and can focus on.”

Take Home Message

Saving doesn’t have to be a chore even though Australia is a pretty costly place to live in. You can always save by following these tricks and tips mentioned above, picked from the dairies of the smartest savers.